Introduction to Government Incentives for Solar Panels

Government incentives for solar energy aim to accelerate the adoption of renewable energy sources, combat climate change, and reduce reliance on fossil fuels. These incentives make solar energy more financially accessible to homeowners and businesses, ultimately fostering a cleaner and more sustainable energy future. The economic benefits extend beyond environmental gains, stimulating job creation in the solar industry and boosting local economies.

The history of government incentives for solar energy in the US is marked by periods of significant support and periods of reduced investment. Early initiatives focused on research and development. However, significant growth in incentives began in the late 1970s and early 1980s, driven by the oil crises and growing awareness of environmental concerns. The Investment Tax Credit (ITC), first introduced in 1978, has been a cornerstone of federal support, undergoing several revisions and extensions over the years. State-level incentives also vary considerably, reflecting differing policy priorities and resource availability.

Types of Government Incentives for Solar Panels

Various types of incentives are available at both the federal and state levels to encourage solar panel installation. These incentives are designed to reduce the upfront costs and ongoing expenses associated with solar energy systems. Understanding the different incentive structures is crucial for maximizing potential savings.

Federal Tax Credits

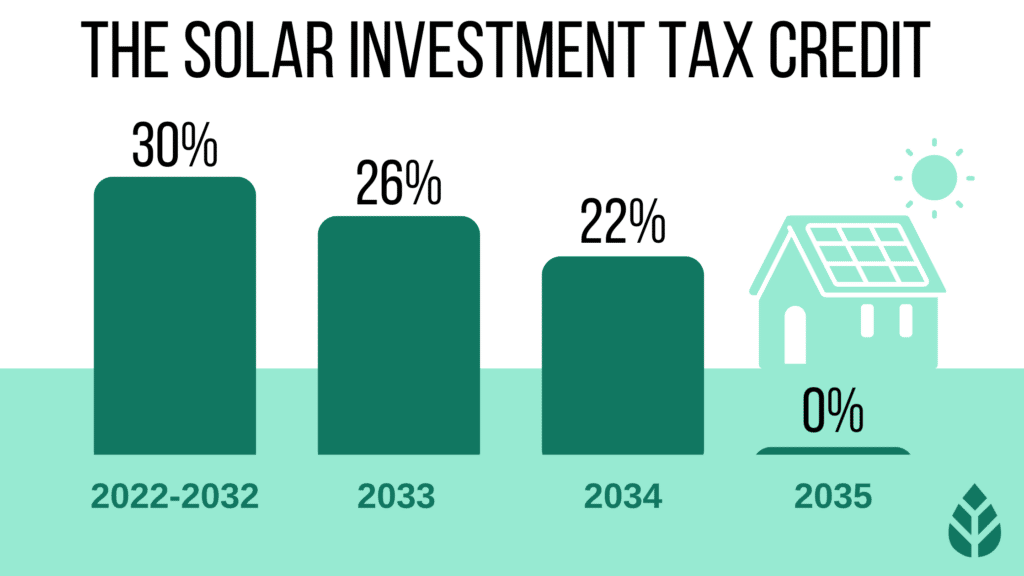

The federal Investment Tax Credit (ITC) is a significant incentive for residential and commercial solar installations. It allows taxpayers to deduct a percentage of the cost of their solar energy system from their federal income tax liability. The current ITC rate is 30%, meaning a homeowner who spends $20,000 on a solar panel system could potentially reduce their tax liability by $6,000. This credit is applicable to both new and existing homes and is a substantial driver of solar energy adoption across the country. The ITC is subject to change and is typically reviewed and potentially adjusted periodically by Congress. It’s crucial to consult the latest IRS guidelines for the most up-to-date information.

State and Local Rebates and Incentives

Beyond the federal ITC, many states and local governments offer additional rebates, tax credits, and other incentives to promote solar energy adoption within their jurisdictions. These incentives can significantly reduce the net cost of a solar panel system. For example, some states offer direct rebates based on the size of the solar system installed, while others provide property tax exemptions or accelerated depreciation schedules for businesses. California, for instance, has a robust suite of state-level programs designed to incentivize solar adoption. These programs often include a combination of rebates, tax credits, and net metering policies (which allow solar energy system owners to sell excess energy back to the grid). It’s vital to research your specific state and local government websites to identify all available incentives.

Other Incentive Programs

In addition to tax credits and rebates, other incentive programs exist. These might include:

* Low-interest loans or financing options: Several programs offer low-interest loans specifically designed for solar energy installations. These programs aim to make solar power more accessible by reducing the financial burden of upfront costs.

* Performance-based incentives: Some programs offer payments based on the amount of solar energy generated. This type of incentive provides an ongoing revenue stream for solar system owners, further reducing the overall cost of solar energy.

* SREC (Solar Renewable Energy Credit) programs: In some states, solar energy system owners can earn SRECs for the renewable energy they generate. These credits can be sold on the open market, providing additional income. This approach incentivizes the generation of renewable energy.

Federal Tax Credits for Solar Panels

The federal government offers a significant incentive for homeowners and businesses to invest in solar energy through the Investment Tax Credit (ITC). This credit directly reduces the amount of tax you owe, making solar panel installation more financially attractive. Understanding the ITC’s eligibility requirements and claiming process is crucial to maximizing its benefits.

The current federal Investment Tax Credit (ITC) offers a significant tax credit for solar energy systems installed on residential and commercial properties. The credit amount is a percentage of the total cost of the system, including installation. This percentage fluctuates over time, so it is essential to check the current rate with the IRS or a qualified tax professional before proceeding with a solar panel installation. Currently, the credit is a percentage of the total cost of the system, with details varying slightly depending on the type of installation.

Eligibility Requirements for the Federal ITC

To qualify for the ITC, your solar energy system must meet several criteria. The system must be new, meaning it has never been used before. It must be installed at a residence or commercial building located in the United States. The system must be used to generate electricity, and it must be connected to the electrical grid (although some off-grid systems may qualify under specific circumstances). Finally, the solar panels must be properly permitted and installed by a qualified professional. Detailed documentation, including receipts and permits, will be needed to support your claim.

Claiming the ITC on Tax Returns

Claiming the ITC involves completing Form 5695, Residential Energy Credits. This form requires detailed information about your solar energy system, including the date of installation, the total cost, and the amount of the credit claimed. You will need to gather all relevant documentation, such as invoices, permits, and any other supporting evidence. Accurate record-keeping throughout the installation process is crucial for a smooth claiming process. The completed Form 5695 is then filed along with your regular tax return (Form 1040). It’s highly recommended to consult with a tax professional to ensure accurate completion and maximize your tax benefits.

Comparison of ITC for Residential vs. Commercial Solar Installations

The ITC applies to both residential and commercial solar installations, but there might be slight differences in the application process and documentation required. Generally, the credit percentage is the same for both, but the overall amount claimed will depend on the size and cost of the system.

| Feature | Residential Installation | Commercial Installation |

|---|---|---|

| Credit Percentage | Currently, a percentage of the total cost (check with IRS for current rate) | Currently, a percentage of the total cost (check with IRS for current rate) |

| Claiming Process | Form 5695, filed with Form 1040 | Form 5695, filed with relevant business tax forms |

| Documentation Required | Invoices, permits, installation reports | Invoices, permits, installation reports, business licenses |

State and Local Incentives for Solar Panels

The federal solar tax credit provides a significant boost to solar energy adoption nationwide, but many states and localities offer additional incentives that can further reduce the cost of going solar. These incentives vary widely depending on geographical location, state energy policies, and local government priorities. Understanding these programs is crucial for maximizing savings and making an informed decision about solar panel installation. This section will explore the diverse landscape of state and local solar incentives across the US.

State and local incentives for solar panels take many forms, including tax credits, rebates, property tax exemptions, net metering policies, and even direct grants. These programs often complement the federal tax credit, resulting in substantial cost reductions for homeowners and businesses. The availability and generosity of these incentives are dynamic, so it is crucial to check with your state and local government for the most up-to-date information.

Variations in State and Local Solar Incentives

State and local solar incentive programs demonstrate considerable diversity across the United States. Some states, particularly those with strong renewable energy goals, offer significantly more generous incentives than others. This disparity reflects variations in state energy policies, economic conditions, and the level of political support for renewable energy initiatives. For example, states in the Northeast and California often have robust programs, while some Southern states may have limited or no state-level incentives. Local governments within states can also add their own unique incentives, further complicating the overall picture.

Comparison of Three State Incentive Programs

To illustrate the diversity of state solar incentive programs, let’s compare three distinct examples: California, New Jersey, and Colorado. These states represent different approaches to incentivizing solar energy adoption, highlighting the wide range of options available across the country.

- California: California’s Self-Generation Incentive Program (SGIP) provides rebates for solar installations, with higher incentives for low-income households. The state also has a strong net metering policy, allowing solar panel owners to sell excess electricity back to the grid. Additionally, California offers various tax credits and other financial incentives at the local level, varying by city and county. This comprehensive approach has fostered significant solar growth in the state.

- New Jersey: New Jersey’s Successor program offers incentives to help residential and commercial customers offset the costs of solar installations. The program is based on a points system, rewarding projects based on factors such as size and location. Similar to California, New Jersey also has robust net metering policies that enable solar energy producers to receive credit for excess electricity. These programs, coupled with federal tax credits, have made New Jersey a leader in solar adoption in the Northeast.

- Colorado: Colorado’s approach differs from California and New Jersey, focusing primarily on property tax exemptions for solar energy systems. While this doesn’t directly reduce the upfront cost of installation, it provides long-term savings by reducing annual property taxes. Colorado also offers a state sales tax exemption on solar equipment. Although lacking the extensive rebate programs seen in other states, Colorado’s incentives contribute to making solar energy more financially attractive.

Key Differences in State Incentive Programs

The following bullet points summarize the key differences between the three state incentive programs discussed above:

- Incentive Type: California emphasizes rebates through its SGIP, while New Jersey utilizes a points-based incentive system. Colorado focuses primarily on property tax exemptions.

- Focus: California’s program includes a strong emphasis on low-income households, while New Jersey’s program targets both residential and commercial customers. Colorado’s approach is more broadly applicable to all property owners.

- Program Structure: California’s SGIP is a more comprehensive program with multiple layers of incentives, whereas Colorado’s program is more streamlined, focusing on tax relief.

- Overall Impact: All three programs contribute to making solar energy more affordable, but their impact varies based on the type and structure of incentives offered. California and New Jersey have seen higher solar adoption rates, potentially linked to their more robust incentive programs.

Qualifying for Solar Panel Incentives

Many government incentives for solar panel installations include income limitations or requirements. Understanding these requirements is crucial to determining your eligibility for financial assistance. These limitations vary significantly depending on the specific program, whether it’s a federal tax credit, a state rebate, or a local incentive. This section clarifies income requirements and verification processes for various incentive programs.

Income limitations for solar panel incentives are designed to target assistance towards households who would most benefit from the financial support. These limits are often based on the Modified Adjusted Gross Income (MAGI) as defined by the Internal Revenue Service (IRS), or a similar metric used by state or local agencies. Failing to meet these income thresholds can disqualify you from receiving the full amount of the incentive or any incentive at all.

Income Verification for Federal Tax Credits

The federal Investment Tax Credit (ITC) for solar energy doesn’t have explicit income limitations. However, to claim the credit, you must meet all other eligibility requirements, which include properly filing your taxes and having sufficient tax liability to offset the credit. Income verification is indirectly done through your tax return. The IRS uses the information provided on your tax form (Form 5695) to verify your eligibility for the credit and the amount you can claim. Any discrepancies or missing information may result in delays or denial of the credit.

Income Verification for State and Local Incentives

State and local incentives vary widely in their income requirements and verification processes. Some programs may have explicit income limits, while others may not. For example, a state might offer a rebate only to households with an income below a certain threshold, perhaps 80% of the area median income. Verification could involve providing proof of income through pay stubs, tax returns, or other documentation requested by the administering agency. Local programs might have even more specific requirements and verification methods, possibly requiring an application with detailed financial information. It is essential to check with your specific state and local government agencies for detailed information on their programs and income requirements.

Illustrative Flowchart for Income-Based Qualification

The following flowchart simplifies the process of determining eligibility for solar panel incentives based on income:

[A simple text-based flowchart could be included here. Due to the limitations of this text-based response, I will describe the flowchart instead. The flowchart would start with a box labeled “Apply for Solar Panel Incentive”. This would lead to two branches: “Meet Income Requirements?” Yes or No. The “Yes” branch leads to “Complete Application and Submit Required Documentation”. The “No” branch leads to “Ineligible for this Incentive”. The “Complete Application…” box would lead to “Approved” or “Denied”, depending on the completeness and accuracy of the application and supporting documentation. The “Denied” box could branch into “Appeal Decision” or “Explore Other Incentives”.]

Qualifying for Solar Panel Incentives

Eligibility for government incentives for solar panels is significantly influenced by the size and type of system installed. Understanding these factors is crucial for maximizing the financial benefits of going solar. This section details how system size and technology impact incentive qualification and the resulting financial gains.

The amount of incentive you receive is directly tied to the size of your solar panel system, usually measured in kilowatts (kW). Larger systems generally qualify for larger incentives, up to a certain limit defined by the specific program. However, the type of solar technology also plays a role, as some incentives might favor specific technologies over others. For example, some programs might offer higher incentives for systems incorporating energy storage solutions like batteries.

System Size and Incentive Amount

The relationship between system size and incentive amount is often linear, up to a certain capacity threshold. For instance, a federal tax credit might offer a certain percentage of the total system cost, but this credit is capped at a specific kilowatt capacity. Exceeding this limit doesn’t increase the credit. Let’s say the tax credit is 30% of the cost, up to a 5kW system. A 3kW system would receive a credit calculated on the full 3kW system cost, while a 10kW system would still only receive a credit based on the 5kW threshold. State and local incentives might have different thresholds and calculation methods. It is crucial to check the specific details of each program for accurate calculations.

Solar Panel Technology Requirements

While many incentive programs are technology-agnostic, focusing primarily on the system’s kW capacity, some might offer additional incentives for specific technologies.

Photovoltaic (PV) Systems: These are the most common type of solar system, converting sunlight directly into electricity. Most incentive programs readily accept PV systems, with the main focus on the system’s overall capacity.

Solar Thermal Systems: These systems use sunlight to heat water or air. While less common than PV systems, some incentive programs specifically support solar thermal technologies, particularly for water heating applications. These programs may have different eligibility criteria compared to PV systems, potentially including requirements for system efficiency or specific components.

Calculating System Size for Incentive Eligibility

Accurate system size calculation is vital for determining the amount of incentive received. This calculation typically involves assessing your energy needs, considering factors like your home’s energy consumption, the amount of sunlight your location receives, and the efficiency of the chosen solar panels and inverters. A qualified solar installer will conduct a thorough site assessment to determine the optimal system size that meets your energy demands while maximizing incentive eligibility. They will provide a detailed proposal outlining the system’s specifications, including the total kW capacity, which will be crucial when applying for incentives. This process ensures you don’t overspend on a larger system than necessary, while also ensuring you maximize the potential benefits from government incentives.

Qualifying for Solar Panel Incentives

Securing government incentives for solar panel installations often hinges on factors beyond simply meeting the technical requirements of the program. Understanding the specific ownership and property type stipulations is crucial for a successful application. This section will clarify the requirements related to homeownership and the type of property involved.

Eligibility for solar incentives is significantly impacted by whether you own or rent your property. Generally, incentives are designed to benefit homeowners, as they represent a long-term investment in the property. Renters, lacking the same vested interest and long-term connection to the property, usually do not qualify for the same types of financial assistance. This is because the incentives are often tied to property tax reductions or direct rebates, which only apply to property owners.

Homeownership as a Prerequisite for Incentives

Many federal and state solar incentive programs explicitly require homeownership. For example, the federal Investment Tax Credit (ITC) is typically claimed by homeowners on their tax returns. State programs, such as those offering rebates or property tax exemptions, similarly restrict eligibility to homeowners. This is because these incentives are structured as deductions or credits applied to the homeowner’s property tax assessment or federal tax liability. A renter, lacking ownership of the property, wouldn’t benefit from these tax-related incentives.

Property Type Restrictions

While single-family homes are the most common recipients of solar incentives, restrictions may apply to other property types. Incentives for multi-family dwellings, such as apartment buildings or condominiums, might be less generous or have different eligibility criteria. Some programs might offer incentives on a per-unit basis, while others may have stricter requirements for obtaining approval for a large-scale solar installation on a multi-unit building. For example, a program might require a homeowner’s association approval for solar installations on condominium buildings. Furthermore, incentives for commercial properties or agricultural buildings often follow separate guidelines and programs altogether. This is because the energy consumption and economic benefits are different compared to residential properties.

Application Process and Required Documentation

Applying for government incentives for solar panels can seem daunting, but with a clear understanding of the process and required documentation, it becomes significantly more manageable. The specific steps and required documents may vary slightly depending on your location and the specific incentive program, so it’s crucial to consult your state and local government websites for precise details. However, the general process remains consistent across most programs.

The application process typically involves several key steps, from initial eligibility verification to final claim submission. Gathering the necessary documentation beforehand is essential to streamline the application process and ensure a timely approval. Failure to provide complete and accurate documentation can result in delays or rejection of your application.

Steps in the Application Process

The application process generally follows a structured sequence. While specific details may differ, the core stages are consistently present. First, you must determine your eligibility for the incentives based on factors such as your system’s size, your location, and your income. Next, you need to complete the application form accurately and thoroughly. Following that, you must gather all required documentation and submit it with your application. Finally, you’ll need to wait for the application to be processed and approved, after which you will receive your incentive payment.

Required Documentation

Preparing the necessary documents in advance is crucial for a smooth application process. Common documents needed include proof of identity and address, proof of ownership of the property where the solar panels are installed, detailed invoices and receipts for the purchase and installation of your solar panel system, including the system’s specifications and details of the installer. You may also need to provide a copy of your federal tax return or other financial documentation depending on the specific incentive program. Some programs require a completed energy audit report to demonstrate energy savings. Finally, a copy of your completed application and any supporting documents is always recommended for your records.

Step-by-Step Guide for Completing the Application

A clear, step-by-step approach simplifies the application process. First, carefully review the eligibility requirements for the specific incentive program. Then, thoroughly complete the application form, ensuring accuracy in all fields. Third, compile all the necessary supporting documents mentioned earlier. Next, organize these documents logically and ensure they are clearly labeled. Finally, submit the completed application form and supporting documents according to the program’s instructions, either electronically or by mail, as specified. Remember to retain copies of all submitted documents for your records.

Common Reasons for Disqualification

Understanding the reasons why applications for solar panel incentives are rejected can significantly improve your chances of success. Careful preparation and attention to detail are key to avoiding common pitfalls. This section Artikels frequent causes for disqualification and offers guidance on how to prevent them.

Applications for solar panel incentives are often rejected due to discrepancies or omissions in the provided documentation, inaccuracies in system specifications, or non-compliance with program requirements. Failing to meet these criteria can lead to delays, denials, or even the forfeiture of incentives. By understanding these common issues, applicants can proactively address them and increase their likelihood of approval.

Incomplete or Inaccurate Application Forms

Incomplete application forms are a leading cause of rejection. Applicants must ensure all sections are fully completed and accurate. Missing information, such as the system’s size, installer details, or proof of ownership, can delay processing or lead to outright rejection. For example, failing to provide a properly completed IRS Form 5695 for the federal tax credit will result in a denial of the credit. It’s crucial to thoroughly review the application form before submission, double-checking all entries for accuracy and completeness.

Lack of Necessary Documentation

Many incentive programs require specific supporting documentation to verify eligibility. This might include proof of ownership, permits, invoices from the installer, system specifications, and photographs of the installed system. Failure to provide the required documentation, or submitting documents that are illegible or unclear, will often lead to rejection. For instance, a blurry photo of the system’s inverter may be insufficient for verification purposes. Applicants should maintain organized records and ensure all necessary documents are included with the application.

Non-Compliance with System Requirements

Some incentive programs specify requirements for eligible solar panel systems, such as minimum efficiency ratings, specific types of panels, or limitations on system size. Systems that do not meet these requirements will not qualify for the incentives. For example, a program might only accept systems using monocrystalline silicon panels, excluding those using polycrystalline or thin-film technology. Applicants should carefully review the program guidelines to ensure their system meets all the specified criteria.

Incorrect System Information

Providing incorrect information about the solar panel system, such as its size, wattage, or location, can lead to disqualification. This might involve errors in the application form or discrepancies between the application and other submitted documentation. For instance, if the application states a system size of 5 kW but the invoice shows a 4 kW system, the application may be rejected. Accurate and consistent information is paramount throughout the application process.

Failure to Meet Deadlines

Many incentive programs have application deadlines. Submitting the application after the deadline will automatically result in disqualification. Applicants should carefully note the deadline and ensure they submit their application well in advance to allow for any potential delays. For example, a program with a December 31st deadline will not accept applications submitted on January 1st. Proper time management and early submission are crucial to avoid missing deadlines.

Navigating the Incentive Landscape

Securing government incentives for solar panel installation can sometimes feel overwhelming. The process involves understanding various federal, state, and local programs, each with its own eligibility criteria and application procedures. Fortunately, numerous resources are available to guide you through this process and ensure you maximize your potential savings. This section details these resources and the support available to simplify your journey towards solar energy independence.

Successfully navigating the complex world of solar incentives requires a multifaceted approach. Understanding the available resources and leveraging the expertise of professionals can significantly streamline the process and improve your chances of securing the maximum possible financial benefits. This includes utilizing online resources, contacting relevant government agencies, and engaging the services of experienced energy consultants and installers.

Government Agencies and Online Resources

Several government agencies and online platforms offer valuable information and support for individuals and businesses seeking solar incentives. The Department of Energy (DOE) provides comprehensive resources on renewable energy technologies, including solar power, and links to relevant state and local programs. The Internal Revenue Service (IRS) website offers detailed information regarding the federal solar tax credit, including eligibility requirements and instructions for claiming the credit. Many states also have dedicated energy offices or websites with information on their specific incentive programs. These resources typically include downloadable guides, FAQs, and contact information for further assistance.

Services Offered by Energy Consultants and Installers

Energy consultants and solar installers provide invaluable support throughout the solar panel installation process, extending beyond the technical aspects of installation. They offer comprehensive services designed to help you understand and leverage available incentives. These services typically include: conducting energy audits to determine your energy needs and the potential savings from solar, identifying and applying for relevant incentives, assisting with the paperwork and application process, and ensuring compliance with all applicable regulations. By partnering with a reputable company, you can reduce the administrative burden and increase your chances of a successful application. Some installers even offer financing options that incorporate incentives into the overall cost, making solar power more accessible.

Helpful Websites and Contact Information

The following list provides a starting point for your research. Remember to verify information with official sources before making any decisions.

It’s crucial to remember that incentive programs and their requirements can change. Regularly checking the official websites for updates is highly recommended.

| Agency/Organization | Website | Description |

|---|---|---|

| Department of Energy (DOE) | www.energy.gov | Provides information on renewable energy technologies and programs. |

| Internal Revenue Service (IRS) | www.irs.gov | Offers details on the federal solar tax credit. |

| Your State’s Energy Office | (Search “[Your State] Energy Office”) | Provides information on state-specific incentives and programs. |

Future of Government Incentives for Solar Energy

The landscape of government incentives for solar energy is dynamic, constantly evolving to reflect technological advancements, economic shifts, and evolving climate policy goals. While current programs offer substantial support, understanding potential future changes is crucial for individuals and businesses considering solar investments. This section explores likely trends and their implications for solar energy adoption.

The future of government incentives for solar energy will likely involve a combination of continued support and shifts in approach. While the core principle of incentivizing renewable energy adoption is expected to remain, the specific mechanisms and levels of support may undergo significant alterations. This is driven by several factors, including budget constraints, the increasing maturity of the solar industry, and the emergence of competing renewable energy technologies.

Potential Changes to Existing Incentive Programs

Existing federal and state tax credits, rebates, and other incentive programs are subject to periodic review and potential modification. For example, the federal Investment Tax Credit (ITC), while currently offering a significant percentage reduction in the cost of solar installations, may see its percentage decrease over time or its phase-out date may be brought forward. State-level programs are even more susceptible to change, often contingent on legislative sessions and budgetary considerations. Some states may choose to extend or enhance their programs, while others might reduce or eliminate them as the market for solar matures and becomes more competitive. For instance, some states have begun to shift from direct rebates to performance-based incentives, rewarding solar installations based on their energy production.

Future Policy Directions for Renewable Energy Incentives

Future policy directions will likely focus on strategies that maximize the impact of public funds. This could include a shift towards performance-based incentives, which reward solar installations based on their actual energy production rather than simply their installation. This approach aims to encourage the development and deployment of higher-efficiency solar systems and better integration with the grid. Another possible direction is an increased emphasis on equitable access to solar energy, ensuring that the benefits of solar adoption are shared across all communities, including low-income households. This might involve targeted subsidies or community solar programs designed to address barriers to entry.

Long-Term Impact of Incentives on Solar Energy Adoption

Government incentives have played a pivotal role in driving the rapid growth of the solar energy industry. The long-term impact of these incentives will depend largely on the extent and nature of future support. Continued, albeit potentially modified, support is crucial to maintain the momentum of solar energy adoption. A premature reduction or elimination of incentives could slow down the transition to cleaner energy sources, potentially jeopardizing climate goals. Conversely, a well-designed and strategically implemented incentive program could accelerate solar energy deployment, contributing significantly to decarbonization efforts and energy independence. For example, the continued growth of community solar programs, supported by targeted incentives, could significantly expand access to solar energy for consumers who may not be able to install solar panels directly on their homes.

Illustrative Examples of Successful Incentive Claims

This section provides a hypothetical example of a successful solar panel incentive claim to illustrate the process and benefits involved. Understanding these processes can help homeowners navigate the application procedure and maximize their savings. While specific details will vary based on location and individual circumstances, this example demonstrates the general principles involved.

Let’s consider the case of the Miller family in California. They decided to install a 5kW solar panel system on their home in 2024. The total cost of the system, including installation, was $20,000. They applied for both the federal Investment Tax Credit (ITC) and California’s Self-Generation Incentive Program (SGIP).

Successful Claim for Federal Investment Tax Credit (ITC)

The Millers qualified for the 30% federal ITC, a common incentive for solar installations. To claim this credit, they gathered all necessary documentation, including their system’s cost, the installer’s invoice, and proof of payment. This documentation was meticulously organized and submitted with their tax return, Form 5695 (Residential Energy Credits).

The IRS reviewed their application and verified the information provided. Upon approval, the Millers received a tax credit of $6,000 (30% of $20,000). This reduced their tax liability directly, resulting in a significant immediate financial benefit.

Successful Claim for California’s Self-Generation Incentive Program (SGIP)

In addition to the federal ITC, the Millers also applied for the SGIP, a state-level incentive program. This program offers rebates based on the size and type of solar system installed. The application process involved submitting an application through the program’s online portal, along with detailed information about their system, installer, and energy usage. The application required detailed technical specifications of the solar panel system and electrical work performed.

After a thorough review, the Millers were approved for a $5,000 rebate through SGIP. This rebate was paid directly to them after the installation was complete and verified by the program administrators. The verification involved inspection of the system to confirm its proper installation and functionality.

Financial Benefits Summary for the Miller Family

By successfully claiming both the federal ITC and the SGIP, the Millers significantly reduced the overall cost of their solar panel system. Their total savings amounted to $11,000 ($6,000 ITC + $5,000 SGIP). This represented a 55% reduction in their initial investment. This substantial financial benefit made the investment in solar energy more affordable and attractive.

This example showcases the potential financial advantages available to homeowners who successfully navigate the process of claiming government incentives for solar panel installations. It highlights the importance of thorough documentation, accurate application completion, and understanding the specific requirements of each incentive program.

FAQ Section

What happens if my application is rejected?

If your application is rejected, you will typically receive a notification explaining the reason for the denial. Review the reasons carefully, address any deficiencies, and reapply if possible. You may also want to consult with an energy consultant for assistance.

Can I claim incentives if I lease my solar panels?

Incentive eligibility often depends on ownership. While some programs may allow for incentives with power purchase agreements (PPAs) or leases, others strictly require homeownership. Check the specific program guidelines to confirm eligibility.

Are there income limits for solar incentives?

Some state and local incentive programs may have income limitations. These limits vary significantly depending on location and program specifics. Check your state and local government websites for details.

How long does the application process typically take?

Processing times vary depending on the program and the volume of applications. Allow ample time for processing and anticipate potential delays. It’s advisable to start the application well in advance of your planned installation.